39+ fed selling mortgage backed securities

Federal Reserve is coming close to finalizing a plan on how to reduce its. Choose from many topics skill levels and languages.

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

Web Get 12 FREE STOCKS Valued up to 30600 With Webull.

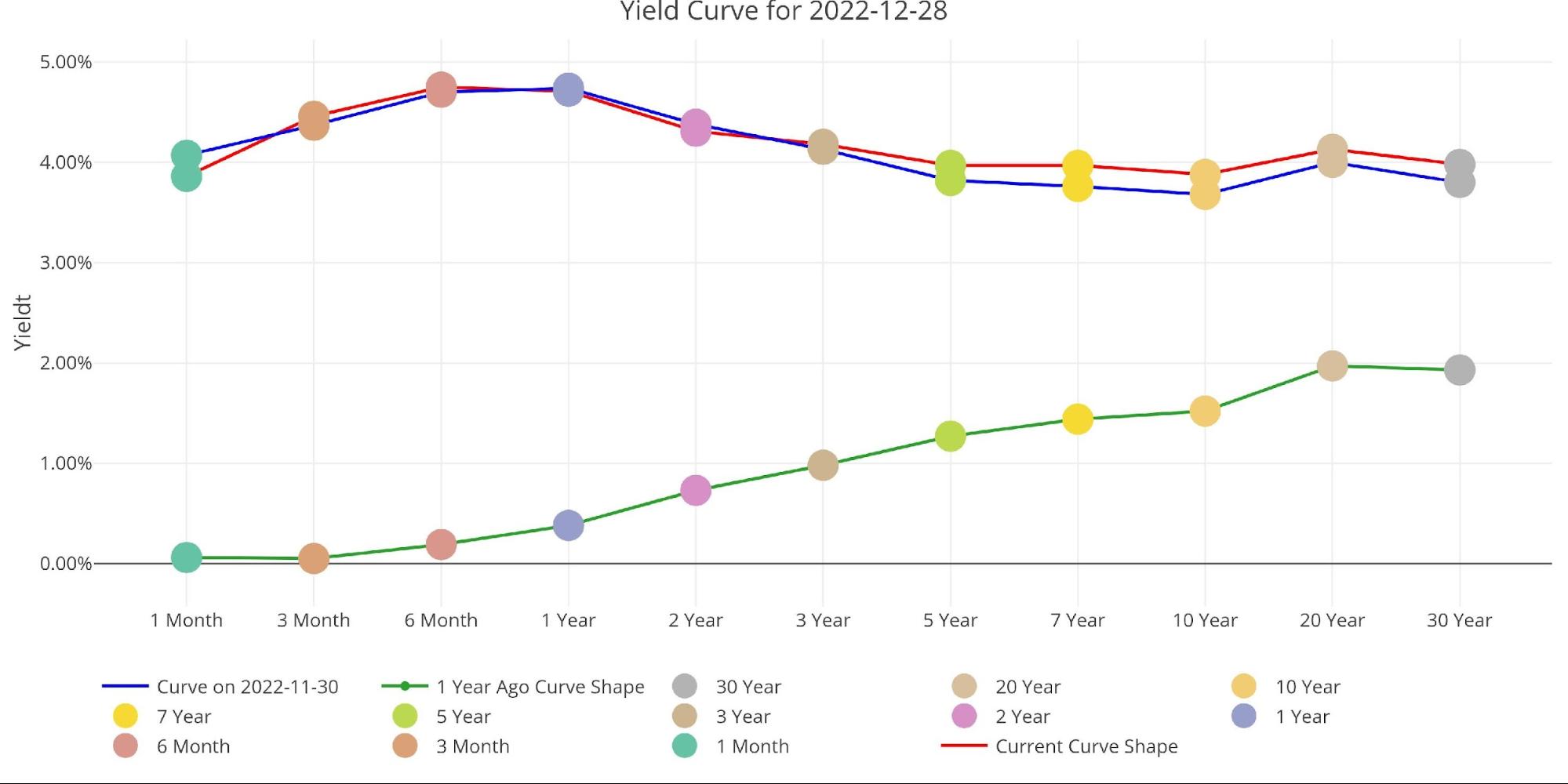

. Web With the target federal funds rate at the effective lower bound the FOMC sought to provide additional policy stimulus by expanding the holdings of longer term. Web When you are selling MBS more supply than demand price of MBS goes down their yield goes up. Join millions of learners from around the world already learning on Udemy.

Federal Reserve gave the capital markets a sneak peek of how its going to lighten its balance sheet particularly. Web We are approximately a decade since the United States last recession and the US. For agency debt and agency.

Ad Find the right instructor for you. Web She noted that Fed officials agree in principle that the central banks securities portfolio should only include those assets issued by the US. Web In the latest minutes from its March meeting the US.

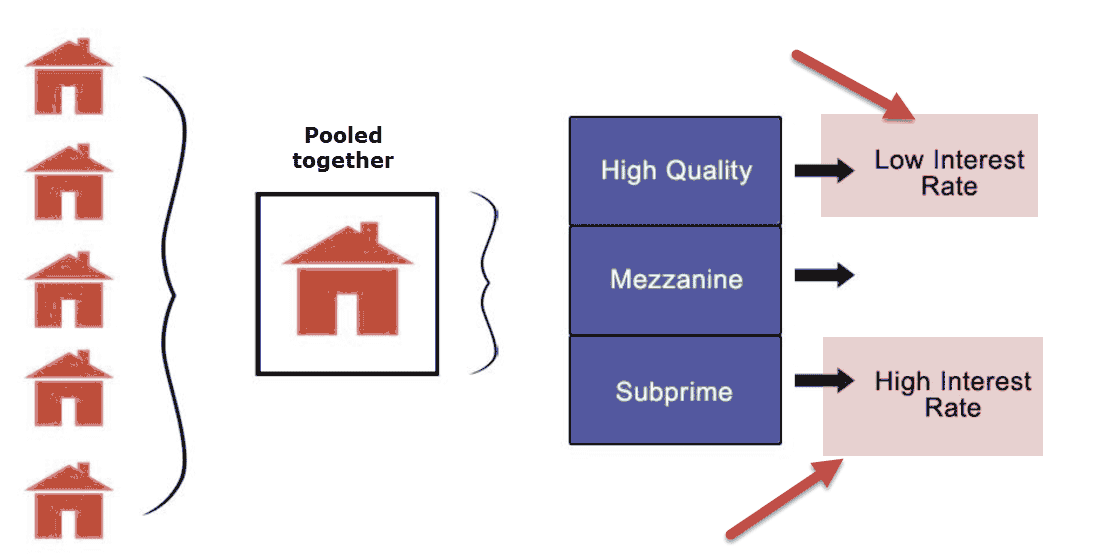

Web The Federal Reserve eventually could resort to selling off mortgage-backed securities on its balance sheet according to the minutes of the central banks last. Web The New York Fed is authorized by the Federal Open Market Committee FOMC to buy and sell agency mortgage-backed securities MBS for the System Open Market. The risk is passed to the mortgages.

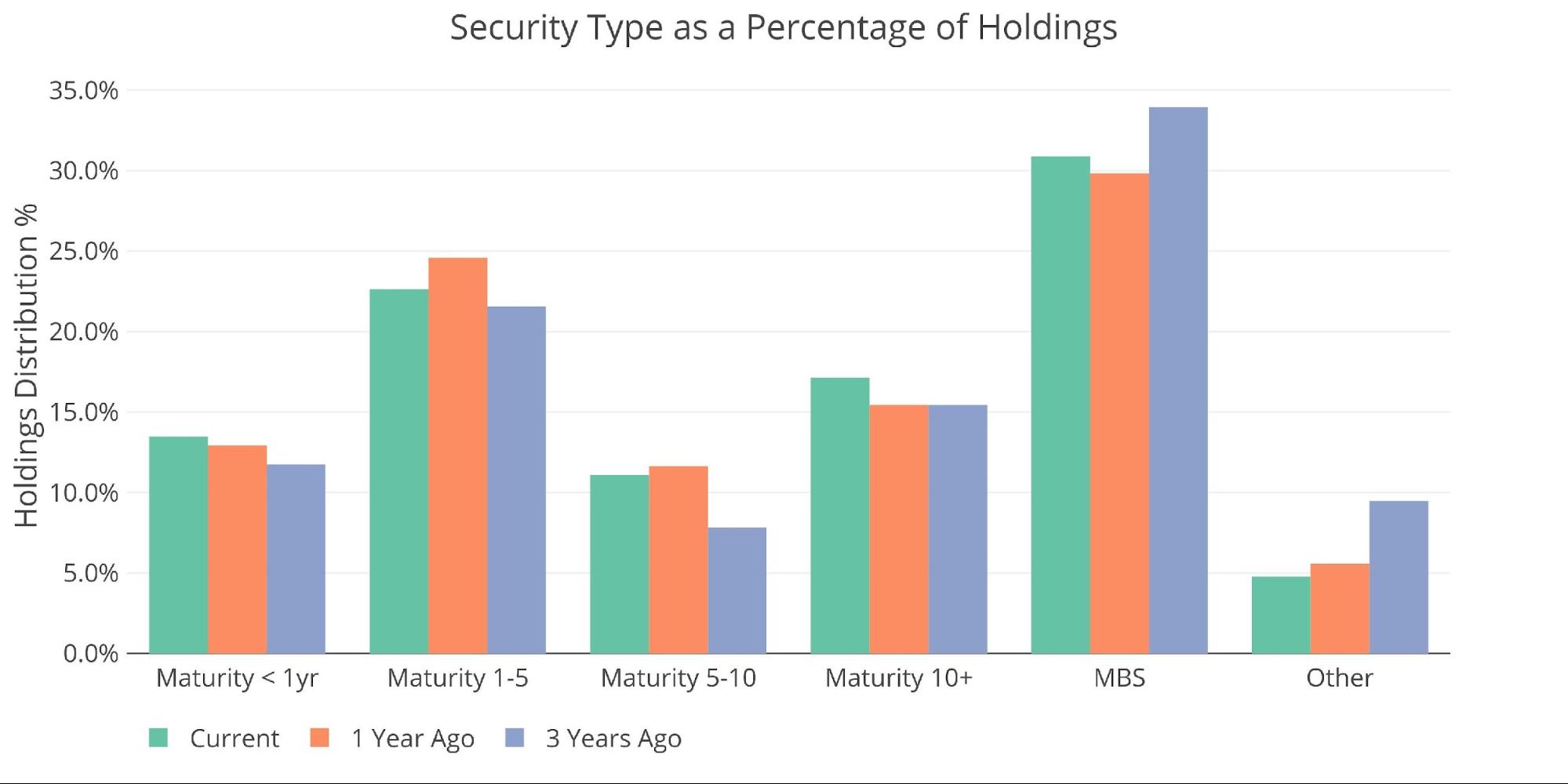

Web Ever since the financial crisis in 2008 Duy said the Feds been filling up its balance sheet with trillions of dollars worth of government bonds and mortgage-backed. Web By the numbers. Web The Fed has slowly been reducing its 88 trillion balance sheet as part of a two-pronged approach to reining in inflation along with raising interest rates.

Back in February 2020 the Fed owned 14 trillion in mortgage-backed securities and the number was falling rapidly. CNBCs Steve Liesman reports on the end of quantitative easing ahead of the next Fed meeting. Web Fed to complete last purchases of mortgage-backed securities.

Web For Treasury securities the cap was initially set at 30 billion per month and in September was increased to 60 billion per month. Decrease demand of mortgages since. Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program.

Web May 16 Reuters - New York Federal Reserve President John Williams said on Monday that selling mortgage-backed securities could be an option for the. Web The Federal Reserve quickly responded to significant financial market disruption at the onset of the COVID-19 pandemic in March 2020 providing stability in a.

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

Asset Backed Securities Rmbs Cmbs Cdos Wallstreetmojo

Financial Crisis Breakdown Part One Securitization Of Mortgages Streetfins

Sales Of Fed S Mortgage Backed Securities May Be Future Option Williams Says Reuters

Why The Fomc Cannot Sell Its Mortgage Bonds

39 Sample Household Budgets In Pdf Ms Word

Is The Fed Worried About The Mortgage Market Schiffgold

S 11

An Introduction To Mortgage Backed Securities Mbs Financeexplained

Is The Fed Worried About The Mortgage Market Schiffgold

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

Mortgage Backed Security Wikipedia

Us Mortgage Backed Securities Statistics Sifma Us Mortgage Backed Securities Statistics Sifma

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

Mortgage Bonds Pose Big Questions For The Fed As It Starts Paring Its Balance Sheet Here S Why Barron S

How The Fed S Balance Sheet Can Affect Mortgage Rates

When The Housing Market Is Owned By Fed Banks Federal Reserve Went From Holding Zero In Mortgage Backed Securities To Over 1 5 Trillion